|

Brief Realtor Rant By Jason Gelios

0 Comments

Article by Guest Writer: Sarah and Mark Velasquez If you dream of launching a home-based enterprise, you may have a lot of work ahead of you. Running a company takes a lot of work, especially if you want to launch it from home. To ensure you can remain productive, you need a suitable space. You may have to consider moving to fit your family and business needs. Finding a Home That Fits Your Family and Business Your home should have enough room to fit your family and business comfortably. To work effectively, you need dedicated office space. When you have space to work, it helps maintain a work-life balance. Your brain learns to associate the office with working. Think about the different qualities that you need out of a new home; working with a Realtor like Jason Gelios is definitely a smart decision when trying to determine what you’re looking for and what’s available. Think about how many bedrooms and bathrooms you want. Larger families may require multiple bathrooms. Likewise, you may want to have a bathroom close to your office space. In addition, your neighborhood style matters. If you want a more walkable neighborhood, narrow your search to areas with a fair walkability score. Urban centers, rural properties, and cul-de-sacs are all popular choices with different benefits. Start preparing for the move early. Balancing a move with starting a business may feel overwhelming, but to-do lists can make a big difference in your life. Create lists of everything you need to do, including closing utility accounts and packing the linen closets. Bettering Yourself as a Business Owner Running a home-based company requires funds, market research, and a business plan. The business plan lays the foundation for your commercial venture. It includes your objectives, products or services, marketing ideas and financial analysis. Your business plan should convince you that you have a solid idea. Likewise, it should persuade lenders to assist you. When writing your plan, be as objective as possible. When you have a strategic and convincing business plan, you have a higher likelihood of qualifying for funding. According to the U.S. government, there are various programs in place to help finance or expand your enterprise. Small businesses may qualify for loans backed by the Small Business Administration. While you can launch a company without a background in business, you may find it valuable to start a degree program. Returning to school to pursue an MBA may provide you with various insights into operations, management, communication, marketing, and leadership skills. If you worry about starting a degree in the middle of moving, online programs offer flexibility. You can learn at your own pace while staying on top of other obligations. Remodeling With Your Business in Mind If your new home does not hit every checkmark for your new business, you may need to consider a remodel upon moving in. Think about what you need to make your office space productive and efficient. You do not want your workspace to feel like a cubicle. Add personal touches and match the furniture to the rest of your home. Make sure your office is functional. Ergonomic chairs, storage, and desk layout work together to create an efficient office. You should be able to easily find essential documents while enjoying the organized space. Launching a home-based company can be the start of a lucrative journey. Before you can reap the benefits, you need a strong business plan and a place to do all of the hard work. Sarah and Mark Velasquez are the creators of Our Perfect Abode. After years of renting, they recently bought their very first home. They’re currently hard at work turning that fixer upper into their perfect abode and are sharing their journey and all the tips and tricks they pick up along the way on their website.

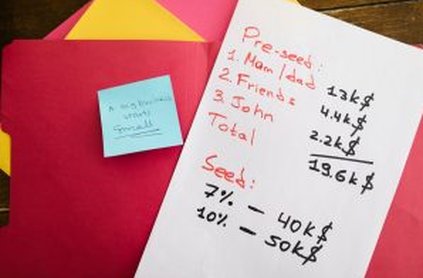

Article by: Guest Writer Sally Norton With the market being especially hot lately, stumbling upon an affordable house could prove to be more challenging than you might have emancipated. Still, now is not the time to be discouraged. If you are determined enough, you will be able to acquire your dream house. You might not have enough money lying around to pay for it in full, but there are other creative ways to finance a home purchase. Ones that we're just about to touch upon. Creative Ways To Finance a Home Purchase That Can Get You The House Of Your Dreams You wouldn't need to think twice about financing your home in an ideal world. Unfortunately, though, the world we live in is anything but ideal. When the lack of money hits you, it's time to get creative. Think outside the box to come up with a way that can get you the property you want without leaving you penniless. Take Out a Mortgage Perhaps not the most creative financing option, but certainly the most popular one, is to take out a mortgage. Bear in mind, however, that not everyone who applies will get approved. Mortgage lenders tend to be quite strict and typically won't lend to those with a credit score lower than 620, nor those whose debt-to-income ratio is below 50%. For people in their 20s, acquiring a mortgage could prove impossible, considering their credit history is short or practically non-existent. Furthermore, they are often drowning in student debt, which prevents them from qualifying for a house loan. On the other hand, conventional mortgages prove an ideal financing solution for those with steady earnings, strong credit history, and savings. The upfront costs fall on the higher side. But the monthly installments are as costly as the average rent from there on out. The mortgage might not be the most creative of creative ways to finance a home purchase, but it remains the most common one. Apply for a Government Loan The requirements for government loans are typically more lenient than those of conventional mortgages. On top of that, there are state and government programs out there that provide closing costs and down payment assistance. To be taken into consideration for a loan granted by the Federal Housing Administration or Department of Agriculture, for instance, you'll need a credit score of 500. You'll probably be required to get additional mortgage insurance, too. Nevertheless, when considering the down payment assistance, this type of financing happens to be just perfect for those with low-to-no savings. Owner Financing On rare occasions, sellers might be willing to agree to owner or seller financing. In a nutshell, this type of financing allows buyers to pay the home off through monthly installments that they pay directly to the seller. It is something to consider for those that cannot take out a standard loan. However, it is also an agreement to be wary of. Seller financing typically comes with a gnarly down payment and enormous interest rates. Buyers are also usually required to have the house fully paid off within five years. While definitely among the creative ways to finance a home purchase, seller financing is certainly not for everyone. Seller financing is an agreement between a seller and a buyer in which a buyer commits to paying monthly installments to the seller until they've fully paid off the house. Rent-to-own Found yourself a house you believe is the one but can't afford it just yet? Well, if you strike the rent-to-own agreement with the owner, then you might as well get ready to move into it! You'll be able to adapt the house to your liking and get necessities every household needs on the premises that the place would be yours once. But first, what exactly does "rent-to-own" mean? Well, it means that, initially, you'll be living in the house as a tenant and paying rent until you've saved up enough money to buy it. In certain situations, a landlord/seller could agree that a portion of the rent you pay covers a part of the purchase price - thus helping you pay for the house sooner. As part of the rent-to-own agreement, "option money" will need to be put down upfront. This is a fee that ranges from 2% to 7% of the home's value. Depending on the deal, it might or might not cover a part of the sale price. Bear in mind that, should you choose to abandon the sale, recouping the option money isn't something you'll be able to do. Enlist the Help of Crowdfunding If everything else fails, family, friends, and even strangers could help you get your hands on your dream house. How? Well, through crowdfunding websites. These allow you to share your story with the world, hoping it would reach the hearts of those in a situation to donate. Every donation matters, no matter how small. In fact, so does a share. An excellent tactic to generate an audience and, therefore, get more donations is to invite people to share your story all over the Internet. Who knows, with the help of generous people, you could be looking at raising down payment money and browsing through Verified Movers for adequate relocation assistance before you know it. Raising money for a down payment, for instance, could be done through crowdfunding. Search for an Investor There are plenty of homes out there that are sold as-is. They require adapting to be habitable but hold serious potential. As such, they could prove interesting to an investor, but to you as well. If you have the time and motivation to fix one up but lack money, you could search for an investor to help you financially. In turn, you'd be agreeing to live on the premises only to move out sometime in the future, thus allowing the said investor to flip the house. You could be looking at getting a portion of the profits generated, as well. Provided that you acquire the funds, you could also end up buying the house from the investor. Don't Be Hasty While creative ways to finance a home purchase might help you acquire a property faster, that doesn't necessarily mean you should. At least, not yet. Being a homeowner is a task that holds a lot of responsibility and is more than just having your name on the deed. After you've signed the deal, property tax, homeowners' insurance, and a whole lot of other fees will be yours to pay. If you and your wallet aren't ready for that yet, though, you might be better off postponing the purchase.

Article by Guest Writer: Ted James If you’re planning on moving for the first time and hoping to keep the process completely calm and stress-free, you should probably begin by acknowledging that this is virtually impossible. However, the earlier you start planning, the less stressful your move will be. Decide what to do with your present house. Before you can pack up and move to your new house, you need to figure out whether you’re going to sell the one you live in, first. Another option might be to move first and sell later if you can afford to do so. And a third possibility is to hold onto your old home and rent it out – but, if you do so, be aware that being a landlord can be a lot more work than you realize, especially from afar. Find a new place to live. When you’re shopping around for a new house, do so with specific requirements in mind. This will keep you from wasting time on homes that simply aren’t suitable. Do your house-hunting with a list of non-negotiable requirements in mind, considering the needs of every member of your family, and considering any future changes that might be made. Also, look at the location. Think about things like schools in the area, travel time, property taxes, and proximity to area attractions. When seeking a new home in the Denver area, the process will go a lot more smoothly if you work with a reliable, professional realtor like Jason Gelios. If you decide to rent instead. You may decide that it makes more sense to rent than to own, especially if you still need to sell your old house, or if you want to get familiar with the area first. However, before you move forward, compare the average costs of apartments for rent in Denver to the average costs of buying a home. When looking at rentals it’s a good idea to stick with listings that offer 3D tours, so you know what you’re really getting. Set a date for your move. Once you’ve found your home and have a definite closing date, it’s time to choose a moving date. While you may be tempted to rush the process so you can get into your new home as soon as possible, it’s advisable to give yourself plenty of time. Also, consider things like time of year, when you need to start your new job, when the school year ends and begins, and more. Keep in mind that if you move during spring and summer, it will be more expensive, but moving during the winter can be a lot more trouble if the weather gets nasty. Hire a moving company. If you opt to work with a moving company, give yourself some time to read reviews and compare rates before hiring anyone. Make sure the company you work with is fully insured and gives you all their estimates and information in writing. If a company acts for a large deposit up-front, you should probably be wary and go with someone else. Additionally, avoid companies with rates so low they seem too good to be true. Start packing. Before you begin packing, you should make an inventory of all the items you intend to take with you, as well as those you intend to get rid of. You should also make sure you have plenty of packing materials – more than you think you’ll need. Try to pack your belongings by category, or by room, so they will be easier to remember and keep track of when it’s time to unpack. And be sure to label every box accurately. Common moving mistakes to avoid. Since so much goes into moving, it’s easy to make a mistake and forget to do things like arrange to have your utilities turned on in your new house, forgetting deadlines, or packing up needed items where you can’t find them. You also don’t want to forget to arrange for childcare on moving day, and possibly put your pet in a kennel so they don’t get hurt or get underfoot. Moving will always be a lot of work. And there will always be stress involved for all parties concerned. However, if you approach your move the right way, you can cut down on a lot of this stress, especially for your kids and pets. Ted James is a husband, father, dog owner, and rock climber living in the Pacific Northwest who devotes a large chunk of his time helping people get back in the driver’s seat of their finances. He created his site, Ted Knows Money, to share money tips and help people get complete control of their finances.

Episode 215 | AskJasonGelios Real Estate Show Erik J. Martin - The Mortgage Reports Contributor Featured expertise by Jason Gelios-Realtor Can two people buy a house together?

It’s pretty common for two people to buy a home together. And your co–buyer doesn’t have to be your spouse; you can buy with a friend, family member, or even a business partner. If you buy a home with someone else, you’ll both be on the hook for mortgage payments. You’ll also share in the equity gains and other perks that come with homeownership. Plus, it can be a lot easier to afford a home when you split the cost with another buyer. Here’s how it works. Click here to read more Guest Writer: Suzie Wilson There’s no getting around the fact that moving is a lot of work. From planning the logistics to packing all of your belongings to helping your family transition to a new living environment, your schedule (and mind) is going to be spoken for the next little bit. The good thing is, you’re moving to the Detroit area. Great neighborhoods, amazing food, world-class performance arts, and incredible scenery are a few of the many perks you can find in here. But to set yourself up for a smooth moving process and settle in quickly, you need a moving checklist. And real estate expert Jason Gelios has provided you with one: Start Planning Early The sooner you begin getting your moving plans together, the better your experience will be. Here are a few ways you can prepare ahead of moving day:

Research Your New Area Becoming acquainted with your new city before you arrive is essential to making it feel like home. Here are a few ways to start setting up your life:

Settle In Smoothly After you get to your new home, you’re going to be tired. Do these things to give yourself some time to relax, adjust, and get to the know the property:

Though moving is hard work, taking time to prepare will make your relocation smoother and less stressful. And it helps that you’re moving to one of the best cities in the world! Check off all the items above, and look for other ways that you can help yourself transition seamlessly into your next chapter. Are you looking for top-tier real estate services in the Detroit area? Contact Jason Gelios today!

I had the pleasure of joining the popular Women Who Rock Success podcast where I shared real estate advice and the current market.

Episode 214 AskJasonGelios Real Estate Show Guest Writer: Sally Norton Photo by Pexels There comes a time in everyone’s life when they wonder if they should make life easier and move closer to their workplace. The commute times can become truly excruciating after a couple of years. So, buying a home closer to work might seem like the perfect solution to this problem. However, this can be a difficult decision to make if you are accustomed to living in your current home. For this reason, we will discuss the things you should look for when buying a house so that you can make an informed decision. For people with families, long commute times can take away the few hours of the day they can spend together. Yet, most parents put their kids’ education first, choosing to live closer to their children’s school. However, most people’s circumstances are not as straightforward as this. There are internal and external factors that may instigate you to cut down the commute time. Let’s see what they may be. Consider home prices If you work in a big city, moving closer to your work might be quite expensive. Obviously, the price of the property will be a huge influencing factor when making this decision. If you are unwilling to spend too much money, the second-best option is to purchase a home in the suburbs of the city, but still closer to your workplace than where you currently live. For example, buying a property in Washington DC costs $444 per square foot on average, whereas a square foot in the nearby suburban town of Rockville, MD, costs only around $270. Obviously, considering property prices is just the beginning, but it is definitely a factor you shouldn’t lose out of sight. Some people become so eager to ditch their painstakingly long commute that they fail to consider that financially they actually cannot handle moving to one of the central neighborhoods. Going into debt is definitely not a viable solution to your commuting problem. Make sure you know what you are getting yourself into money-wise before making the final call. Buying a home closer to work includes more than just the home itself It is not only the real estate prices in the given neighborhood that delimit your options. Surely, the area you live in should satisfy a number of your needs and preferences. Hence, it makes sense to observe the purchase of the new home as more than just the price of the property. The safety and accessibility of the neighborhood might be an even better indicator of the actual adequacy of the home. In that sense, if your workplace is located in or near a neighborhood with a high crime rate, then commuting to work is a better option. On the other hand, if commuting involves spending a lot of time stuck in traffic, buying a home closer to work will save time and nerves. High-density traffic around the neighborhood you live in could be the deciding factor. Also, take into account the taxes, real estate agent’s fees, the moving costs, etc. It is necessary to see the whole picture. Relocation experts at zippyshellcolumbus.com can provide you with a free estimate so that you can decide if moving house is actually worth it. Consider the costs of the commute The average commute in the US amounts to 25.5 minutes, which is relatively manageable. However, over 10 million Americans have to drive more than an hour in one direction to get to work. These hours can take a toll on the commuter’s patience and their wallet. Instead of spending money on gas and car maintenance, you could direct it toward paying off the mortgage of your new home. According to some estimates, each mile you cross to work costs you almost $800 a year in commuting expenses. In line with this, reducing the duration of the commute from one hour to half an hour would end up saving you an astonishing $24,000 a year. That is why many people decide to take this step and forgo spending more time in their car than necessary. If purchasing a new home is a big step for you, you might consider renting instead. Renting a place near your office is definitely less of a commitment than buying a home. Whatever you feel more comfortable with, be sure to make the right choice for your family and your future. Also, if you cannot afford to move at the moment, consider finding friends or colleagues you can carpool with. This will reduce the costs of maintaining your car as well as make your morning drive more cheerful. Carpooling is a great way to reduce costs and loneliness. The stress you experience is a tell-tale sign Of course, financial matters are not the only factor that should drive your decision. In fact, basing your decision solely on how much it will cost you is even a bit cruel to your sense of well-being. Sure, you want to live sensibly, but if you start losing your head because you have to get up before sunrise to make it to work on time is just going to aggravate you and make you feel miserable. And the point of making a living is to enable you to live comfortably, after all. Rushing to work every morning can eat up your nerves In that sense, if you see that the levels of stress you experience because of the commute have a bad impact on your mood, sleep, and motivation, the decision should be easy to make. In these cases, buying a home closer to work is a literal lifesaver! Too many accidents happen because the driver didn’t get enough sleep and snoozed off on the highway. Compromising your life in this way just so you can save your money is a bad idea, so do yourself a favor and start looking at property listings as soon as possible.

|

AuthorJason Gelios is a Husband and Father. After that, a Top Producing REALTOR®, Author of the books 'Think like a REALTOR®' and 'Beating The Force Of Average', Creator of The AskJasonGelios Real Estate Show and Expert Media Contributor to media outlets across the country. Archives

July 2024

Categories |

RSS Feed

RSS Feed