|

7 minute read by Jason Gelios REALTOR® Here is a breakdown of the eviction process from episode 156 of The AskJasonGelios Real Estate Show. Lease agreement signed A lease agreement is accepted by the tenant to lease the property from the landlord. Problem arises As the tenant leases the property, the issue arises that put both landlord and tenant in communication with each other. Landlord and Tenant try to resolve issue on their own It is always best for the landlord and tenant(s) to try to resolve the issue before heading to court. Landlord and Tenant go to court If no resolution has occurred between the tenant(s) and landlord, then the next step is to head to court. Complaint is filed in court At this stage a complain is officially filed with the court. Eviction notice is sent After a complaint is filed with the court, an eviction notice is then sent. Almost always a landlord should also hand deliver the notice to the tenant(s). Judge makes decision Ultimately the judge will make a decision in either the landlord or the tenant's favor. At this point one of two things happens: Tenant wins and stays in the property Landlord wins and tenant leaves - Judge issues court order or Warrant of Eviction - Tenant leaves voluntarily or sheriff throws them out Tenant may need to pay landlord based on lease agreement or local law: - Court costs - Attorney fees - Unpaid rent - Damages and penalties Always consult with a qualified attorney before proceeding with an eviction or accepting an eviction notice. Watch the video on this topic here

0 Comments

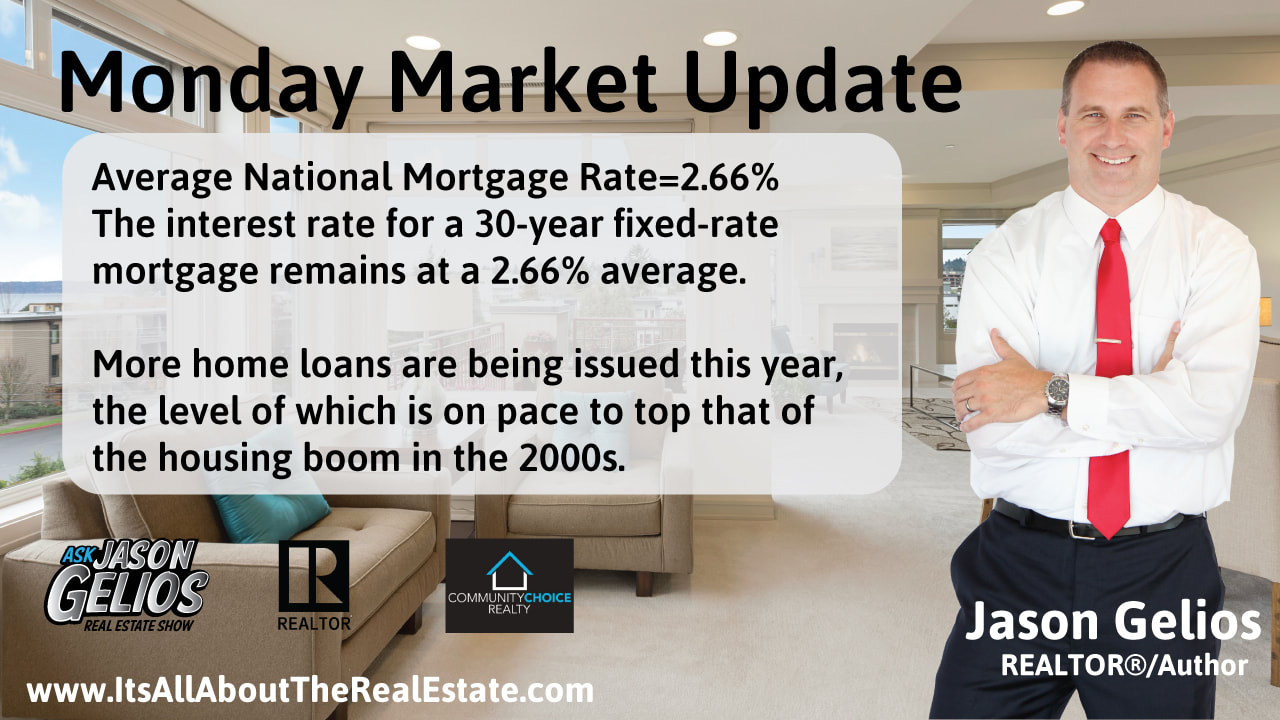

I had the pleasure of being a source for an article about the record low mortgage rates.

Check out the article at the link: https://money.yahoo.com/mortgage-rates-sink-to-new-low-163330459.html Join me in my guest appearance on The Ask Shardie Round Table Talk Show! With over 500k listeners monthly, myself and other professionals will talk about current events, real world marketing and other topics that may come up around business.

A quick home buyer tip that could save hundreds of dollars! Credit scores play a big role in determining whether you’ll qualify for a loan and what your loan terms will be. So, keep your credit score high by doing the following:

Check for errors in your credit report. Thanks to an act of Congress, you can download one free credit report each year at annualcreditreport.com. If you find any errors, correct them immediately. Pay down credit card bills .If possible, pay off the entire balance every month. Transferring credit card debt from one card to another could lower your score. Don’t charge your credit cards to the max. Pay down as much as you can every month. Wait 12 months after credit difficulties to apply for a mortgage. You’re penalized less severely for problems after a year. Don’t order items for your new home on credit. Wait until after your home loan is approved to charge appliances and furniture, as that will add to your debt. Don’t open new credit card accounts. If you’re applying for a mortgage, having too much available credit can lower your score. Shop for mortgage rates all at once. Having too many credit applications can lower your score. However, multiple inquiries about your credit score from the same type of lender are counted as one if submitted over a short period of time. Avoid finance companies. Even if you pay off their loan on time, the interest is high and it may be considered a sign of poor credit management. Two Minute Tip Tuesday Video |

AuthorJason Gelios is a Husband and Father. After that, a Top Producing REALTOR®, Author of the books 'Think like a REALTOR®' and 'Beating The Force Of Average', Creator of The AskJasonGelios Real Estate Show and Expert Media Contributor to media outlets across the country. Archives

July 2024

Categories |

RSS Feed

RSS Feed