|

By Jason Gelios REALTOR®/Author 5 min. read Many people have asked me if they can appeal a home appraisal if they are not happy with the results. Many lenders are open to reviewing the home appraisal again.

Here are some tips on appealing the appraisal:

One part of the appraisal will be an area showing comparable properties the appraiser used to get to their value of your home. These are also known as ‘Comps’. This area of the appraisal report usually provides the most concern for home owners. Sometimes these properties will not be a solid comparable to the property being appraised. Before appealing the appraisal, ask yourself these questions:

When appealing a home appraisal you will want to bring all the information backing up your appeal to the lender. Making it easier for them to review your appraisal will save time and get you an answer back faster. If the lender does not agree with your appeal, don’t sweat. An appraisal is just a subjective opinion based on a snapshot in time. You could request another appraisal but that will end up costing you more money.

0 Comments

Source: REALTOR« Magazine Credit scores play a big role in determining whether you’ll qualify for a loan and what your loan terms will be. So, keep your credit score high by doing the following:

Check for errors in your credit report.Thanks to an act of Congress, you can download one free credit report each year at annualcreditreport.com. If you find any errors, correct them immediately. Pay down credit card bills.If possible, pay off the entire balance every month. Transferring credit card debt from one card to another could lower your score. Don’t charge your credit cards to the max.Pay down as much as you can every month. Wait 12 months after credit difficulties to apply for a mortgage.You’re penalized less severely for problems after a year. Don’t order items for your new home on credit.Wait until after your home loan is approved to charge appliances and furniture, as that will add to your debt. Don’t open new credit card accounts.If you’re applying for a mortgage, having too much available credit can lower your score. Shop for mortgage rates all at once.Having too many credit applications can lower your score. However, multiple inquiries about your credit score from the same type of lender are counted as one if submitted over a short period of time. Avoid finance companies.Even if you pay off their loan on time, the interest is high and it may be considered a sign of poor credit management. A 6 min. read by Jason Gelios REALTOR®

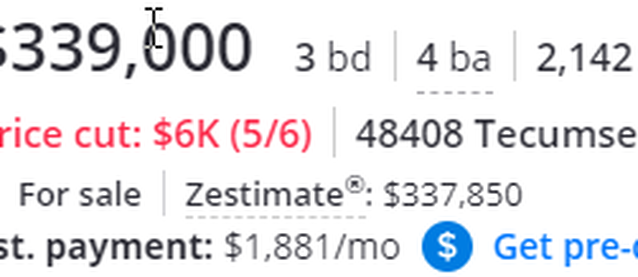

Many home owners and sellers ask me this question about the Zillow Zestimate feature on Zillow.com. In this brief article I share some of the things that Zillow takes into consideration when presenting a home value on their website. Here are 6 things that Zillow uses to calculate a Zestimate.

The bottom line: Zillow’s Zestimate feature is a rough estimate of your home’s value. It should never be construed as a definite value. A homes value is subjective; meaning it is a matter of opinion by the appraiser or value calculator. There is no perfect way to get a home value. The best way to gain you’re homes value is by hiring an appraiser or having a REALTOR® do the homework to come up with a home value for that moment in time. By Jason Gelios REALTOR® 6 min. read In this brief article I share 6 questions to ask yourself if you are considering selling a home.

1. Is there enough equity? There are costs involved in selling a home. Not having enough equity or money at closing to cover those expenses will make it harder to sell your home. 2. Has anything changed with your financial situation? Maybe you are making more money compared to when you were originally thinking of buying another home which would allow you to purchase a bigger home. Consider your current financial situation and needs. Of course, you should never max out your budget on a home. 3. Have you outgrown your neighborhood? Is the area you live in not appealing to you anymore? Are you looking for a change from the suburbs to the rural area or vice versa? 4. Can you remodel or add on to your current home? Are you really looking to sell or just need a little more space? It may be wise to look at this option before selling your current home. 5. Is the current housing market appealing to you? Will you gain what you need if you sell your home and purchase another one? Get with an expert to see where the current real estate market is and determine if it makes sense for you to move. 6. Is it worth the effort? No matter how you look at it moving takes a lot of work. Ask yourself if the move is worth the effort. If it is, then happy moving! The best time to buy or sell real estate is when it is right for you. Knowing everything that is involved will help you make the right decision. A brief update on what the real estate market is doing. |

AuthorJason Gelios is a Husband and Father. After that, a Top Producing REALTOR®, Author of the books 'Think like a REALTOR®' and 'Beating The Force Of Average', Creator of The AskJasonGelios Real Estate Show and Expert Media Contributor to media outlets across the country. Archives

July 2024

Categories |

RSS Feed

RSS Feed